Content

Just make sure you’ll have quick access to these funds if circumstances change; otherwise, you’ll actually lower your business liquidity. You’ll have to go through the process of setting up the appropriate accounts with your bank or investment broker, but by doing so, you’ll earn passive income on the money your business isn’t currently using. Some companies go one step further by offering a small discount to customers who pay their invoice within the first week they receive it. This lowers the total amount you receive, but in some cases, having cash in hand is more valuable than getting the full payment at a later time.

- However, if used strategically, loans can be a great way to improve the liquidity of a small business, both when you’re struggling and when you’re doing so well that you’re considering expansion.

- Cash liquidity and cash flow are critical predictors of small business survival—those with less liquidity and irregular cash flows are least likely to keep their doors open.

- There’s never been a better time to start a small business than right now.

- Businesses have a hierarchy of needs that are related to their sizes and their resources.

This phenomenon occurs at some point in the lives of almost all small businesses. Blind application of the debt-equity ratio criteria to a business in that phase can, and often does, threaten its survival. It is the manager’s policy to have enough on hand at the end of the month to take care of next month’s anticipated sales. The company probably has little experience on which to draw for predictions of indirect expenses. Intercity’s owner-manager realizes that it is important to know how the company’s bank balance is doing.

Cash ratio

Liquidity ratios are most useful when they are used in comparative form. Securities that are traded over the counter , such as certain complex derivatives, are often quite illiquid. For individuals, a home, a time-share, or a car are all somewhat illiquid in that it may take several weeks to months to find a buyer, and several more weeks to finalize the transaction and receive payment.

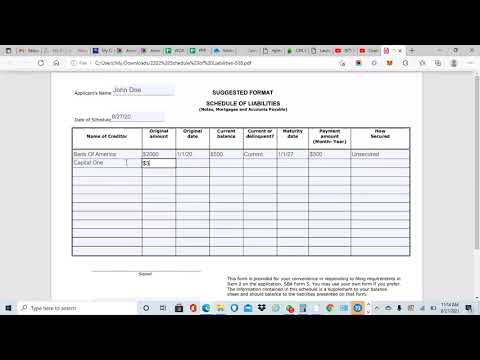

Distribution graph showing both the distribution of cash buffer days in 25 metro areas. 50 percent of firms had less than fifteen cash buffer days and only 40 percent had more than three weeks. Efforts to provide small businesses relief from impacts of the coronavirus (COVID-19) pandemic have developed. Cities like New York and Seattle will delay tax collections and make low-interest loans available. Again, it’s best to compare your business’s quick ratio against industry benchmarks and close competitors to draw more accurate conclusions. Sadly, many small businesses learned this lesson the hard way, as COVID-19 lockdowns and capacity restrictions crippled their operating cash flow while they continued paying expenses just to keep the lights on.

Pay Your Bills as Late as Possible

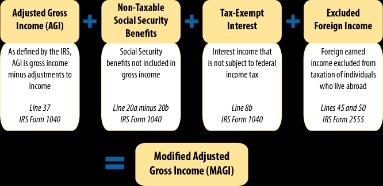

The quick ratio suggests an even more dire liquidity position, with only $0.20 of liquid assets for every $1 of current liabilities. Liquidity ratios are an important class of financial metrics used to determine a debtor’s ability to pay off current debt obligations without raising external capital. Liquidity ratios measure a company’s ability to pay debt obligations and its margin of safety through Liquidity In Small Business the calculation of metrics including the current ratio, quick ratio, and operating cash flow ratio. Ideally, your current ratio will always be 1 or greater, as values below 1 can indicate liquidity problems. If, for example, a company has excellent inventory management, however, their current ratio might dip below 1 even though they do have the assets available to cover their short-term liabilities.

If you can swing it with your lender, one way to get around the problem is to kick the can down the road and turn your current liabilities into long-term debt through refinancing. Spiralling overhead costs can be a huge drain on your business’ cash reserves. The more revenue you have, the more likely you’ll be able to pay your bills. “Sell more” might sound painfully obvious, but when a liquidity crisis is looming, it’s nice to have all your options clearly on the table. A company that doesn’t have many current assets but lots of long-term assets could potentially be illiquid while still being solvent.

Illiquid assets

Inventory is all the goods and materials a business has stored away for future use, like raw materials, unfinished parts, and unsold stock on shelves. Of the four current asset types, it’s the least liquid, because it’s the hardest to turn into cash. Acquiring additional equity when the company is in this https://quick-bookkeeping.net/filing-income-tax-return-late/ phase of growth is extremely difficult. The original investors have watched their holding dwindle from the losses of the start-up period. Now they want their capital returned before allowing other investors to reap the benefits. Also, original investors have often paid steep prices for their ownership.

What does it mean when a small business owner has low liquidity?

A company's liquidity indicates its ability to pay debt obligations, or current liabilities, without having to raise external capital or take out loans. High liquidity means that a company can easily meet its short-term debts while low liquidity implies the opposite and that a company could imminently face bankruptcy.

You can spot financial snags and liquidity crisis before they start to snowball. Here are some reasons why liquidity is important for small businesses. The more money you save, the more cash you’ll have available to use for other purposes. Assets are resources that have economic value and are owned or controlled by an individual, organization, or government entity. Stand out and gain a competitive edge as a commercial banker, loan officer or credit analyst with advanced knowledge, real-world analysis skills, and career confidence. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

How to get instant access to financing

The better a business’s liquidity ratio, the more attractive it will be to lenders and investors, both of which can be extremely important for growth. Overall, think of the quick ratio as a “stress test” of your business’s liquidity during a short-term emergency. A quick ratio above 1 indicates a highly resilient business that can meet all its current liabilities in under 90 days. Monitoring these financial ratios allows you to better gauge any liquidity risk and make adjustments or take action. Since it can be used to pay off debts and make purchases quickly and easily, cash is considered the standard measure of liquidity.

As a bank, they accepted deposits from general consumer depositors, small businesses, startups, and businesses like private equity and venture capital firms. SVB took on a relatively risky strategy as a lender by lending broadly to the tech sector, including startups. Since many tech startups, such as those dealing with crypto, are not necessarily profitable or heavily reinvest in their growth, there was a lot of risk in the loans that SVB was making. Demonstrating your proactive liquidity management and holding early discussions about potential risks can build trust. It may even yield advantages such as favorable terms, reduced interest rates, and more capital.

Sell your assets

This measures a company’s ability to pay off its current liabilities with its current assets, including cash, accounts receivable and inventories. In short, the cash ratio simulates a worst case scenario, such as a financial crisis, when even highly liquid assets like marketable securities and accounts receivable cannot readily be converted into cash. Also listed on the balance sheet are your liabilities, or what your company owes. Comparing the short-term obligations with the cash on hand and other liquid assets helps you better understand the financial position of your business and calculate insightful liquidity metrics and ratios. Low liquidity ratios raise a red flag, but “the higher, the better” is only true to a certain extent. At some point, investors will question why a company’s liquidity ratios are so high.

How liquid should a small business be?

Conventional wisdom holds that a business should have liquid assets (cash in bank accounts and very liquid investments) equal to three to six months of operating expenses.

This can occur because the risk of failure is shared between the businessperson and the lender, and it is not shared symmetrically. Thus, one objective of public policy toward small business is to increase access to capital in the presence of liquidity constraint. The quick ratio is a calculation that measures a company’s ability to meet its short-term obligations with its most liquid assets. In the example above, the rare book collector’s assets are relatively illiquid and would probably not be worth their full value of $1,000 in a pinch.

How to measure liquidity

The ratios vary by the assets used, with some allowing for unpaid accounts or unsold inventory, while others only count available cash as an asset. Liquidity ratios have some drawbacks, including their inability to take cash flow into account. Nor do they evaluate the feasibility of a company liquidating its assets. To ensure that you always have enough liquid capital, work to raise sufficient capital at every stage of your company’s growth.

- Regpack allows you to accept multiple payment types, create custom invoices, send reminders and accept payment in a secure and straightforward way.

- The type of bailout will also likely increase inflation due to the protection of SVB’s failed balance sheet.

- Current Assets is an account on a balance sheet that represents the value of all assets that could be converted into cash within one year.

- The quick ratio or acid test ratio is a stricter form of the current ratio that only includes highly liquid current assets.